Watchdog report: Norcross-founded firm violated conflict laws, broke disclosure rules in covert takeover of public health insurance funds

Health insurance funds that cover more than 100,000 public employees in New Jersey routinely ignore public contracting laws while sending millions in taxpayer money to powerful private firms, according to a report issued by the state’s top watchdog on Tuesday.

The report from Acting Comptroller Kevin Walsh focuses on Conner Strong & Buckelew, the Camden-based insurance brokerage that for many years was led by Democratic Party leader George Norcross.

Walsh’s investigation of three public insurance funds, which last year controlled nearly $650 million in taxpayer money, found that the company steered contracts to preferred vendors, presided over conflicts of interest, and operated with little meaningful oversight from local officials.

Conner Strong and an affiliate called Perma even held multiple positions within each of the funds, with one arm of the company essentially managing another, Walsh found. Perma, as “executive director” of the fund, also had a role in evaluating proposals from potential competitors, according to the investigation.

The bottom line, Walsh reported, was a steady stream of taxpayer money flowing to a single private firm operating outside of ethical bounds.

Conner Strong and Perma, during five years working as paid consultants for the Schools Health Insurance Fund, were paid more than $36 million, state investigators found. The fund manages health coverage for employees in 111 school districts throughout New Jersey.

“Without adequate disclosure, competition, or accountability, a for-profit firm has effectively gained control over public health insurance funds,” according to the comptroller’s 34-page report. “The result is an unauthorized takeover of a core public function by a private entity — and a serious risk to public trust and public dollars.”

Walsh, in a press release accompanying the report, added: “There is no clearer conflict of interest than when a company writes the RFP, reviews the bids, and then steers the contract to itself. What makes this worse is that the vendor concealed from the state and its public entity clients that it was operating on all sides of contracting processes that are supposed to protect taxpayer funds.”

Conner Strong, through a spokesman and an attorney, pushed back on Walsh’s findings, attacking the comptroller’s office as a politically motivated “rogue agency.” The company demanded an apology and a “full retraction” from Walsh, asked for the governor to appoint a special counsel to investigate him, and urged the Legislature to take immediate action to rein him in.

“Meetings are also being scheduled with the Department of Banking and Insurance and the Department of Community Affairs to ensure the truth is heard and the [insurance funds] are protected,” according to a press release from Conner Strong.

The company’s statement referred questions to Matthew Boxer, a predecessor of Walsh who served as New Jersey’s comptroller from 2008 to 2013. Boxer now does legal work for Perma.

In an interview on Tuesday with The Jersey Vindicator, Boxer claimed that state regulators maintain careful oversight on the public health insurance funds and were well aware that Conner Strong and Perma are related entities working together inside many New Jersey insurance pools, such as those singled out by Walsh.

Boxer also said that each of the insurance funds is overseen by appointees named by member school boards or municipalities that belong to the funds. These board members, he said, make the decisions on hiring vendors and other professional advisers.

“I’ve been working with Perma for about a year now, and everything that I’ve seen indicates that these health funds are run very well,” Boxer said. “Look at the state health benefit plans, they’re near collapse. These joint insurance funds have performed well, and the numbers bear that out.”

Dan Fee, a spokesman for Norcross, called Walsh an “underqualified, politically ambitious” stand-in for state Attorney General Matt Platkin, who brought a sweeping criminal corruption case against the party leader last year only to have it tossed out of court before trial. The case is on appeal.

“This time, it’s not Matt Platkin whose well-known obsession with Norcross we are speaking of, but rather his stalking horse, state Comptroller Kevin Walsh,” Fee said. “Like Platkin, when there’s a new governor in January, the comptroller will be out of office. Every taxpayer should be grateful that these two obsessives will be gone from public life in a matter of months.”

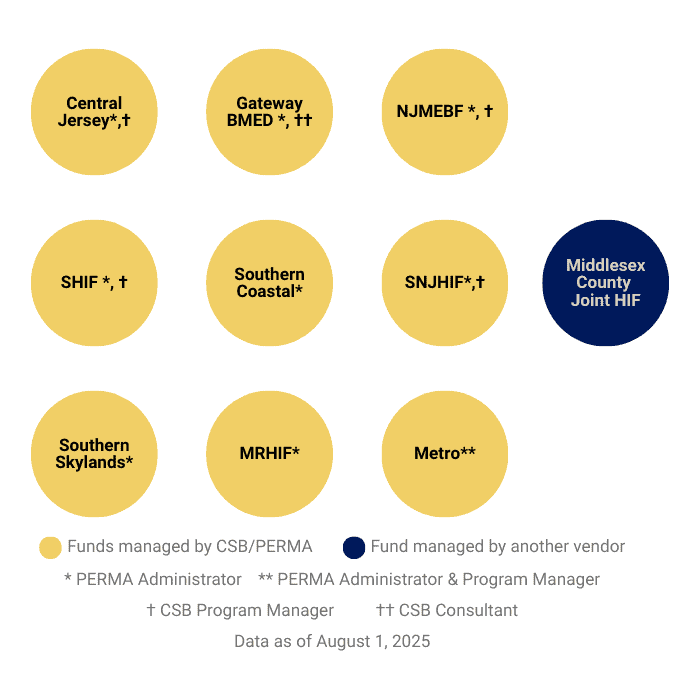

Fee also released a statement from the board chairs of six of the nine public health insurance funds in New Jersey managed by Perma. Walsh’s report “is replete with inaccuracies and reflects a misunderstanding of the New Jersey insurance market,” said the statement, which also claimed that Perma funds have outperformed the State Health Benefits Program.

Last year, the state fund covered about 800,000 active and retired New Jersey public employees but continues to face mounting losses. “The HIFs … have outperformed the state plan for years,” according to the statement.

Several of the criticisms raised by Boxer and the other backers of Conner Strong and Perma are directly contradicted in Walsh’s report.

Walsh’s investigators, for example, found no evidence that Conner Strong had even informed the state or members of the fund boards that it was closely related to Perma and that the pair were essentially the same corporate entity.

The investigators also found that Perma had never made full, complete or accurate disclosures about its corporate conflicts of interest, and had even made misleading statements about its status.

“State rules require fund professionals and their employees to disclose conflicts of interest, but that did not happen,” according to Walsh’s report.

In addition, Walsh found that misleading information promulgated by Perma and Conner Strong included the wholesale invention of a bogus “marketing entity” known as the Hi Fund that had no board, no charter and was never approved by the state. Several board members of other health funds operated by Perma told Walsh they had never even heard of such a fund.

“The Hi Fund is not even a real business entity, let alone a public entity or an appropriate shared services tool — it is a front used to generate business for Conner Strong and Buckelew,” the comptroller’s report stated.

Walsh referred his findings to the Department of Banking and Insurance, the Department of Community Affairs, the New Jersey Attorney General, and the School Ethics Commission. He ordered the three funds he examined to review their policies and appoint independent experts to bring contracting and other key practices in line with state law.

In addition, Walsh has put a temporary hold on plans by two of the Perma-managed health funds to create a purchasing consortium that would extend across much of the state.

“At a time when more public entities are relying on health insurance funds to provide coverage, it’s critically important that the state ensure insurance funds and vendors who receive taxpayer money act ethically, avoid conflicts of interest, and comply fully with the law,” Walsh said.

Walsh’s report is only the latest from the comptroller’s office to find troubling issues with New Jersey’s procurement of public-entity insurance. The comptroller, in past audits of municipalities and school districts, has documented how insurance brokers have built-in conflicts of interest, misrepresent costs associated with alternatives, and fail to disclose the commissions and incentives.

Conner Strong has been the focus of several of these investigations, including a 2012 probe authored by Boxer that raised questions about Norcross’s actions regarding insurance coverage for the Delaware River Port Authority. Norcross, however, denied any wrongdoing and was never charged in any insurance-related prosecution.

It is unclear what ties he still maintains to Conner Strong, the brokerage he built and led for many years. A spokesman said he no longer serves as executive chairman but declined to answer when asked why he left the position or if the party leader still has any position with or interest in the company.

Norcross bought Perma in 2007 for about $10 million, according to David Grubb, a former Bergen County public official who founded the Parsippany-based firm in the 1980s amid a municipal insurance crisis that had led to skyrocketing premiums for property and casualty coverage.

Perma successfully oversaw the creation of joint insurance pools, or JIFs, that allowed towns to save money on coverage by pooling resources and spreading out liabilities. Perma later expanded the concept to create new municipal pools for employee health coverage. In recent years, Perma has expanded to providing management for county-based insurance funds and services such as the joint purchase of electricity.

Today, Perma manages 35 funds statewide, a network that runs entirely on taxpayer money and includes hundreds of municipalities and school districts.

If this reporting helped you understand something important about New Jersey, consider supporting it.

The Jersey Vindicator is an independent, nonprofit newsroom focused on accountability and transparency. Our reporting is funded by readers — not corporations, political insiders, or big advertisers.

Reader support makes this work possible — and helps ensure it continues.

Jeff Pillets is a freelance journalist whose stories have been featured by ProPublica, New Jersey Spotlight News, WNYC-New York Public Radio and The Record. He was named a Pulitzer Prize finalist in 2008 for stories on waste and abuse in New Jersey state government. Contact jeffpillets AT icloud.com.